The Tax Planning Money Move: Save $4,500 By Thinking Beyond April

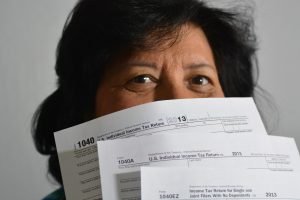

April 15th arrives. You scramble to find receipts you threw away in July. You panic-search for charitable donation confirmations. You realize you could have maxed out your retirement account but didn’t. You owe $8,000 and there’s nothing you can do about it now.

It’s too late.

Welcome back to The Clever Wallet’s Money Moves series. You’ve built your financial foundation (Moves #1-10), and now it’s time to talk about the strategy that separates people who pay the IRS everything they ask for from people who keep thousands more in their pockets: year-round tax planning.

This is the Tax Planning Money Move, and it’s worth $4,500+ annually to anyone who implements it.

The Money Move: Treat Tax Planning as a 12-Month Strategy, Not an April Scramble

Most people think about taxes once a year, then spend 51 weeks ignoring them. That’s costing you thousands.

The winning approach:

- Plan in January (meet with CPA)

- Execute all year (track expenses, make contributions)

- Optimize in December (strategic year-end moves)

- File in April (no surprises, maximized deductions)

Result: $3,000-7,000 less in taxes annually, same income

The $4,500 You’re Handing the IRS Unnecessarily

Meet Brian and Sharon. Both freelancers. Both making $85,000 annually. Both filing single with no dependents.

Brian’s approach: April-only tax thinking

What Brian does:

- Ignores taxes until April

- Throws away receipts all year

- Doesn’t track business expenses

- Forgets about retirement contributions

- Makes no strategic moves

Brian’s April 15th result:

- Income: $85,000

- Deductions: Standard deduction only ($13,850)

- Taxable income: $71,150

- Federal tax owed: $11,234

- Plus self-employment tax: $12,008

- Total tax bill: $23,242

Brian writes a check for $8,000+ (after quarterly payments) and feels sick.

Sharon’s approach: Year-round tax planning

What Sharon does:

- Meets with CPA in January ($400)

- Tracks every business expense (daily)

- Maxes retirement contributions (monthly)

- Makes strategic December moves

- Files with confidence in April

Sharon’s April 15th result:

- Income: $85,000

- Business expense deductions: $12,000

- Retirement contributions: $23,000 (solo 401k)

- Adjusted gross income: $50,000

- Standard deduction: $13,850

- Taxable income: $36,150

- Federal tax owed: $4,146

- Self-employment tax: $7,068

- Total tax bill: $11,214

Plus: Sharon’s $23,000 retirement contribution grows tax-free

The difference: $12,028 in Brian’s pocket vs. Sharon’s

Wait, that’s not all. Sharon’s $23,000 retirement contribution will grow to approximately $160,000 by retirement (assuming 8% returns over 30 years).

Sharon’s real advantage over Brian: $12,000 in taxes saved THIS YEAR + $160,000 in retirement wealth built

Same income. Completely different financial outcomes. The only difference? Planning.

Why Most People Fail at Tax Planning

The Mental Barriers

Barrier #1: “Taxes are too complicated”

Reality: Basic tax planning is simple. You don’t need to understand the entire tax code. You need to know 5-8 common strategies.

Barrier #2: “I’ll deal with it in April”

Reality: Most tax-saving strategies must be executed before December 31st. April is too late.

Barrier #3: “I can’t afford a CPA”

Reality: A $400 CPA meeting that saves you $4,000 in taxes is an ROI of 1,000%. You can’t afford NOT to.

Barrier #4: “I’m not organized enough”

Reality: Receipt-tracking apps do 90% of the work. You just photograph receipts with your phone.

Barrier #5: “I don’t make enough money for tax planning to matter”

Reality: Tax planning matters MORE at lower incomes. Saving $3,000 on a $50,000 income is 6% of your income—massive.

The April-Only Cycle

January-November: Ignore taxes completely

December: Realize you should have been planning

January-March: Scramble to remember expenses

April: Discover you owe way more than expected

May-December: Tell yourself “next year I’ll plan better”

Repeat forever

Breaking this cycle saves thousands annually.

The Tax Planning Money Move: Your 12-Month System

Ready to keep $4,500+ more of your money? Here’s the month-by-month system:

JANUARY: Plan Your Strategy

Action items:

- ✅ Schedule CPA meeting for tax planning (not filing)

- ✅ Review last year’s return (what deductions did you miss?)

- ✅ Set goals: retirement contributions, charitable giving

- ✅ Choose expense tracking system (Expensify, QuickBooks)

- ✅ Calculate quarterly estimated tax payments

CPA planning session agenda:

- Your projected income for the year

- Deduction opportunities based on your situation

- Retirement contribution strategy

- Quarterly estimated tax schedule

- December optimization tactics

Cost: $300-500

Value: $3,000-7,000 in tax savings

ROI: 600-2,333%

Don’t skip this meeting. It’s the highest-ROI hour of your entire year.

FEBRUARY-NOVEMBER: Execute Daily

Action items:

- ✅ Photograph every business receipt immediately

- ✅ Categorize expenses weekly (takes 10 minutes)

- ✅ Make quarterly estimated tax payments (April, June, Sept, Jan)

- ✅ Maximize retirement contributions monthly

- ✅ Track mileage for business driving

Expense tracking apps:

- Expensify: Photo receipt, auto-categorizes, $5/month

- QuickBooks Self-Employed: Full accounting, $15/month

- Wave: Free for basic tracking

- Shoeboxed: Mail receipts, they scan them, $20/month

The daily habit: Take 30 seconds to photograph every business receipt at time of purchase. Weekly 10-minute review to categorize.

Sharon’s system: Every evening, she reviews the day’s expenses. Coffee with client? Photograph receipt, categorize as “meals.” New laptop? Photograph receipt, categorize as “equipment.” Takes 2 minutes per day. Saves thousands annually.

DECEMBER: Optimize Before Year-End

This is the most important month for tax savings.

Strategic December moves:

Move #1: Max out retirement contributions

- 401k employee contribution limit: $23,000 (2024)

- IRA contribution limit: $7,000 (2024)

- Solo 401k (self-employed): Up to $69,000 (2024)

- All contributions must be made by December 31st (except IRA, which has until April)

Move #2: Bunch charitable donations

- If you usually donate $5,000 annually

- Consider donating $10,000 this year

- Take standard deduction next year

- Result: Higher deduction this year when it matters

Move #3: Accelerate business expenses

- Need new equipment next year? Buy it in December

- Section 179 allows full deduction in year of purchase

- Up to $1,160,000 in equipment can be deducted immediately

Move #4: Prepay January expenses (if applicable)

- January mortgage payment → Prepay in December for deduction

- Q1 estimated taxes → Pay in December if cash flow allows

- Business subscriptions → Prepay annual in December

Move #5: Harvest tax losses (if you invest)

- Sell losing investments before December 31st

- Use losses to offset gains

- Reduce capital gains tax

- Rebuy similar (not identical) investments after 30 days

Move #6: Max out HSA (if eligible)

- $4,150 single / $8,300 family (2024)

- Triple tax-advantaged (deductible, grows tax-free, withdrawn tax-free)

- Contribution deadline: December 31st

Move #7: Review business structure

- Sole proprietor paying high self-employment tax?

- Consider S-Corp election (CPA advice required)

- Can save $5,000-15,000 annually in self-employment tax

Sharon’s December checklist:

- ✅ Final $2,000 solo 401k contribution (hitting $23,000 max)

- ✅ $2,500 charitable donation (bringing total to $5,000 for year)

- ✅ $3,000 HSA contribution (maxing it out)

- ✅ Buy new camera for business ($1,800 expense in December instead of January)

- ✅ Prepay January mortgage ($2,200 additional deduction)

- ✅ Calculate final Q4 estimated tax payment

Total December deductions added: $11,500

Tax savings from December optimization: $3,450 (at 30% effective tax rate)

JANUARY-APRIL: File Confidently

Action items:

- ✅ Collect all tax documents (W-2, 1099s, 1098)

- ✅ Review expense tracking (already organized all year)

- ✅ Meet with CPA or use tax software

- ✅ File by April 15th

- ✅ No surprises—you planned all year

Sharon’s April experience: She logs into her expense tracking app, exports the year’s data, meets with her CPA for 1 hour, reviews and signs her return. Total time: 2 hours. Total owed: $3,500 (expected based on quarterly payments). No stress.

Brian’s April experience: He spends 12 hours scrambling for receipts, cursing himself for not tracking, estimating expenses he can’t prove, and discovering he owes $8,000+ he wasn’t prepared for. High stress.

Tax Planning Strategies by Situation

If You’re W-2 Employee (Not Self-Employed)

Your top strategies:

- Max out 401k through payroll

- $23,000 annual limit (2024)

- Reduces taxable income dollar-for-dollar

- Tax savings: $5,750 at 25% tax bracket

- Max out HSA (if eligible)

- $4,150 single / $8,300 family

- Triple tax-advantaged

- Tax savings: $1,037 single / $2,075 family at 25% bracket

- Itemize if above standard deduction

- Mortgage interest

- State/local taxes (up to $10,000 cap)

- Charitable donations

- Medical expenses (above 7.5% of AGI)

- Claim all available credits

- Child Tax Credit: $2,000 per child

- Child Care Credit: Up to $3,000

- Education credits: Up to $2,500 per student

- Saver’s Credit: Up to $1,000 (income limits apply)

Total potential savings: $6,000-10,000 annually

If You’re Self-Employed/Freelancer

Your top strategies:

- Track EVERYTHING as business expense

- Home office (portion of rent/mortgage, utilities)

- Dedicated phone line or cell phone (business %)

- Internet (business %)

- Computer and equipment

- Software subscriptions

- Professional development (courses, books)

- Travel (business portion)

- Meals with clients (50% deductible)

- Business insurance

- Marketing and advertising

Sharon’s tracked business expenses: $12,000 annually

- Max out solo 401k

- Employee contribution: Up to $23,000

- Employer contribution: Up to 25% of compensation

- Total possible: Up to $69,000 (2024)

- Deduct health insurance premiums

- Self-employed health insurance deduction

- Reduces both income tax AND self-employment tax

- Set up SEP-IRA or SIMPLE IRA

- Alternative to solo 401k

- Simpler administration

- Still significant tax savings

- Consider S-Corp election

- Reduces self-employment tax

- Requires CPA guidance

- Worth it if making $60,000+

Total potential savings: $10,000-20,000 annually

If You’re High Income ($150,000+)

Your top strategies:

- Max ALL retirement accounts

- 401k: $23,000

- Backdoor Roth IRA: $7,000

- Mega backdoor Roth: Additional $46,000 (if plan allows)

- HSA: $4,150/$8,300

- Tax-loss harvesting

- Systematically harvest losses

- Offset capital gains

- Carry forward excess losses

- Qualified Business Income deduction

- 20% deduction for pass-through income

- Phases out at high incomes

- Strategic entity structuring helps

- Bunching deductions

- Bunch 2 years of charitable giving into one year

- Exceed standard deduction in alternating years

- Donor-Advised Fund

- Large charitable contribution in high-income year

- Deduct immediately

- Distribute to charities over time

Total potential savings: $20,000-40,000+ annually

Common Tax Planning Mistakes

Mistake #1: Not Tracking Deductible Expenses

The cost: Brian lost $12,000 in legitimate business deductions because he didn’t track them. At 30% effective tax rate, that’s $3,600 unnecessarily paid to IRS.

The fix: Use receipt-tracking app starting today. It takes 30 seconds per receipt.

Mistake #2: Missing the December 31st Deadline

The cost: You can’t go back in time. Retirement contributions, equipment purchases, charitable donations must be completed by December 31st.

The fix: Set a December 15th reminder to do final year-end optimization.

Mistake #3: Not Making Quarterly Estimated Payments

The cost: Underpayment penalty (typically 5-8% of amount owed) plus interest.

The fix: Pay 100% of last year’s tax liability divided by 4, quarterly. No penalty even if you owe more.

Mistake #4: Mixing Personal and Business Expenses

The cost: IRS audit risk increases. Legitimate deductions get disallowed because you can’t prove business purpose.

The fix: Separate credit card for business expenses. Clear documentation of business purpose.

Mistake #5: Overlooking the Home Office Deduction

The cost: Home office deduction can be $3,000-8,000 annually. Most self-employed people don’t take it.

The fix: If you have dedicated space for business (exclusive use), calculate square footage and deduct portion of rent/mortgage, utilities, internet, insurance.

Mistake #6: Forgetting Mileage Deduction

The cost: Standard mileage rate is $0.67/mile (2024). Business driving of 5,000 miles = $3,350 deduction missed.

The fix: Use mileage tracking app (MileIQ, Everlance). Automatically tracks business vs. personal miles.

The CPA Question: DIY or Hire?

When to DIY Your Taxes

You can probably DIY if:

- ✅ W-2 employee only

- ✅ Standard deduction (not itemizing)

- ✅ No complex investments

- ✅ No business income

- ✅ No real estate

Use: TurboTax, H&R Block, FreeTaxUSA

Cost: $0-120

Time: 2-4 hours

When to Hire a CPA

Hire a CPA if:

- ✅ Self-employed or business owner

- ✅ Multiple income streams

- ✅ Rental properties

- ✅ Stock options or complex investments

- ✅ Income over $150,000

- ✅ You want strategic planning, not just filing

Cost: $300-1,000 for filing, $300-500 for planning session

Value: Typically saves 3-10X more than cost

Time saved: 10-20 hours of your time

Sharon’s calculation:

- CPA planning session: $400

- CPA tax filing: $600

- Total cost: $1,000

- Tax savings from planning: $4,500

- Net benefit: $3,500

- Plus: 15 hours of her time saved (worth $750+ as freelancer)

ROI: 350%

The Hybrid Approach

Best of both worlds:

- Year 1: Hire CPA for planning AND filing (learn the strategy)

- Year 2-3: DIY with software, apply learned strategies

- Year 4: Return to CPA for check-up and new strategies

This approach: Maximizes learning while minimizing annual cost.

Your Tax Planning Action Plan

Ready to save $4,500+ in taxes this year? Here’s your month-by-month action plan:

This Month (Getting Started)

✅ Schedule CPA planning session for next month

✅ Download receipt-tracking app

✅ Gather last year’s tax return to review

✅ Calculate your projected income for this year

✅ List all possible business expenses

Next Month (Planning Session)

✅ Meet with CPA for tax planning (not filing)

✅ Get specific strategies for your situation

✅ Set up quarterly estimated tax payment schedule

✅ Create retirement contribution plan

✅ Start tracking expenses daily

Throughout the Year (Executing)

✅ Photograph every business receipt

✅ Categorize expenses weekly

✅ Make quarterly estimated payments

✅ Maximize retirement contributions monthly

✅ Keep running tally of deductions

December (Optimizing)

✅ Max out retirement contributions

✅ Bunch charitable donations if beneficial

✅ Buy needed business equipment before 12/31

✅ Prepay January expenses if applicable

✅ Harvest tax losses in investments

✅ Max out HSA

April (Filing Confidently)

✅ Review organized expense tracking

✅ Meet with CPA or use software

✅ File by April 15th

✅ No surprises—you planned all year

✅ Celebrate keeping thousands more

The Tax Planning Challenge

I challenge you to implement year-round tax planning and save $3,000+ in taxes this year.

What you’ll do:

- Schedule CPA planning session

- Track expenses daily for 12 months

- Max retirement contributions

- Execute December optimization

What you’ll save:

- Year 1: $3,000-5,000 in taxes

- Year 10: $30,000-50,000 cumulative

- Plus retirement growth: $150,000+

From one strategic decision to plan year-round.

Most people will keep doing what they’ve always done: ignore taxes until April, panic, overpay by thousands, repeat.

Don’t be most people. Schedule that CPA meeting today.

Want to see exactly how to set up expense tracking and plan your December optimization? Watch our Money Moves video with step-by-step demonstrations.

The Bottom Line

The Tax Planning Money Move is simple: Think about taxes 12 months a year, not just in April.

Brian and Sharon make the same income. Sharon pays $12,000 less in taxes because she plans. That’s not advanced tax strategy. That’s basic planning anyone can do.

Meet with CPA in January. Track expenses all year. Optimize in December. File confidently in April.

One systematic approach. Thousands saved annually. Tens of thousands saved over a decade.

Stop overpaying the IRS. Start planning strategically.

This is Money Move #11 from The Clever Wallet. Build on your foundation (Moves #1-10) by keeping more of your hard-earned money through strategic tax planning.

What’s your next money move?

Related Money Moves:

- The Retirement Contribution Money Move

- The Business Expense Tracking Money Move

- The Year-End Optimization Money Move

This is part of The Clever Wallet’s Money Moves series—financial strategies that actually work. Subscribe to our YouTube channel for video versions of every money move, and download our free Tax Planning Calendar at TheCleverWallet.com.